Part 2. How to treat property investments like a business - Mindset

This is part 2 in our series on How to treat your real estate investments like a business. If you haven't already, we suggest you first read Part 1 - Where most investors fail.

Step 2. Educate yourself

Most professionals spend years building up their skills and knowledge in a chosen industry. University degrees, tafe, professional development and years of on the job training become the foundation of their knowledge. Yet when it comes to investing, people think they can just choose an asset class and do a little research then expect everything to work out.

Continual education differentiates successful investors from those who never really get off the ground. When you're starting out you should try to learn as much as you can. There are heaps of free or cheap resources around to teach you more than enough to get started. Read books, talk to professionals, attend seminars, whatever you can do to increase your knowledge. Every dollar you spend upfront here has the ability to either make you 10x or save you 10x.

I also encourage people to expand their research beyond the asset class they’re looking at. You might have already decided that you want to invest in property but learning about other asset classes as well will give you a more rounded knowledge of investment principles so you can better identify trends and respond to events. Just make sure that you do take action on the information you’re learning about. It’s easy to get overwhelmed by too much information so there comes a point where you just need to jump in and give it a go. You'll learn way more from doing, you just want to make sure you have enough knowledge to avoid the costly mistakes made by many newbies.

Step 3. Take emotion out of the picture

I have to remind myself of this one every time I go to an open home. You walk through the doors and see the unlimited potential of a place and the huge value that it will add to your portfolio. It's love at first sight. Unfortunately when it comes to investing, that emotion tends to have a way of skewing reality and leading to poor choices.

It's much better to take the emotion out of the equation as much as possible and there are a number of strategies you can use to help achieve this.

Focus on the numbers – when assessing the viability of an investment or reviewing ongoing operation it helps to focus on the numbers to ensure you're making decisions rationally. The numbers won’t lie and so you'll get a much clearer picture of how the property actually looks. People will often keep this in mind when purchasing but the rule stands true for the ongoing management as much as the initial purchase. It's easy to justify not raising rents in line with the market rate because you have nice, reliable tenants in place and you feel sorry for them having to pay more. While it can be a good strategy to keep your rent just under market value to keep an excellent tenant, you shouldn't be subsidising someone's living expenses at the cost of your own financial security. This leads us onto our next tip.

Be careful renting to friends and family – Many investors become unstuck renting to friends and family because you're entering into a dual relationship with them and it becomes very difficult to keep emotion out of the picture. We'll cover the do's and don'ts of renting to friends and family in a future article so make sure you sign up to our newsletter if this is something you're considering.

Engage a professional property manager - A good way to keep some distance from your tenants is by engaging a professional property manager. First of all they will have a good understanding of the market rent and will be able to negotiate increases on your behalf. They will also be able to navigate loss of payments or other problems when they arise. They charge relatively low fees for their services so are definitely worth considering.

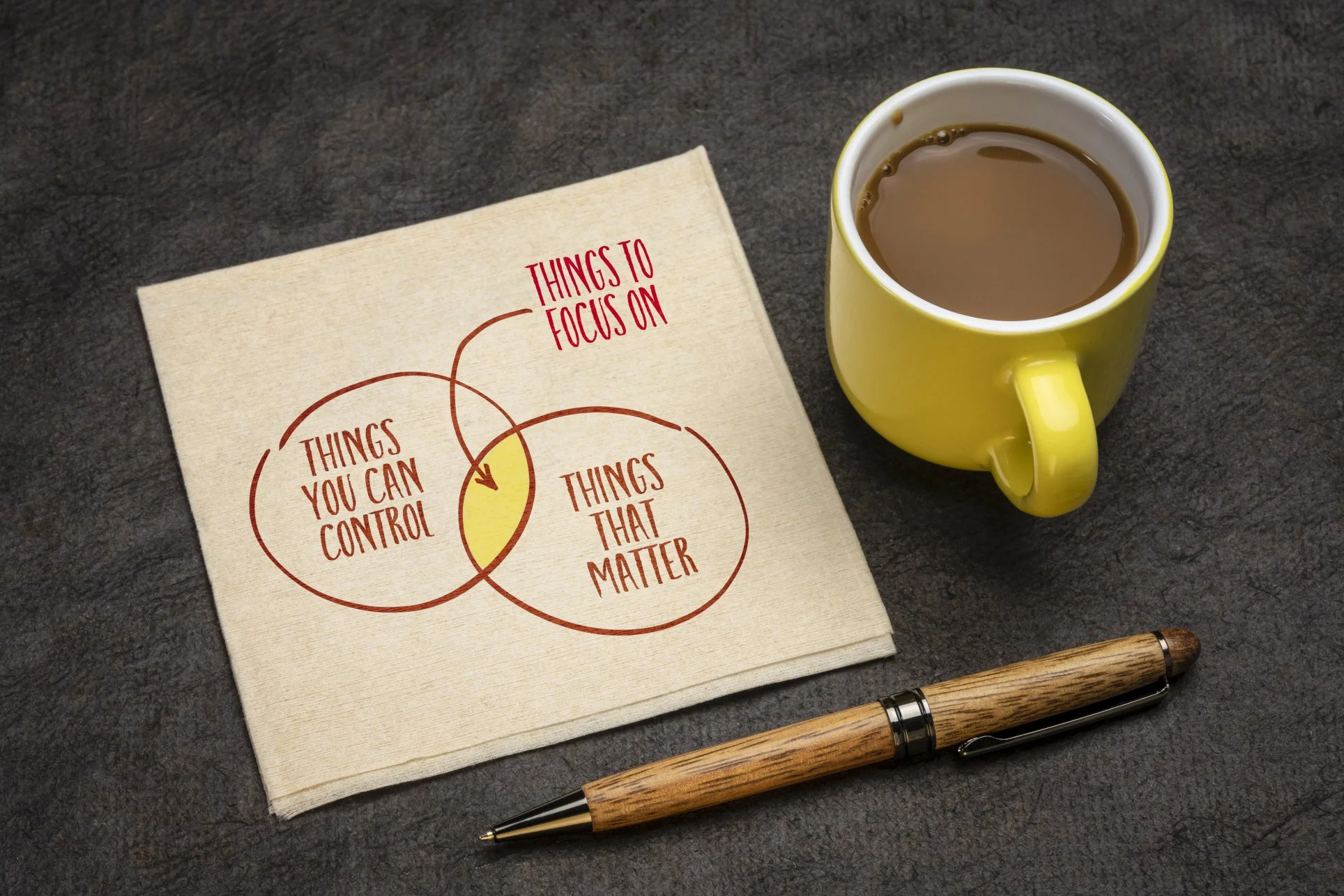

Step 4. Focus on what matters Ask anyone how their day was and their response is likely to be 'busy'. Life seems to be getting busier and busier. It can seem overwhelming and impossible to stay on top of things and get everything done. They good news with investing is that you actually only need to do a few things well and the rest will generally take care of themselves. For example, if you spend time researching and finding a good property manager initially, they will save you days of hard work every year.

You don't need to do everything yourself but you do need to stay focused on what really matters. This is why goal setting is why setting up your plan in step one is so important. Your goals will provide you with the roadmap so that you can identify and pursue only those things that will take you in the direction that you want to go and make a real difference in your life. For this reason I suggest that reviewing your portfolios performance is something you should do yourself and never fully outsource.

It's easy to get distracted from your goals at times so a good way to help you stay focused is to surround yourself with other like minded people who can support you and help you stay on track.

Make sure you check out Part 3 of this series - Teamwork