Rental Yield: A Guide for Property Investors

Rental yield is a measure of how much money you are likely to earn on your investment property each year. It is the annual rental income earned from a property over the property value shown as a percentage.

Rental yield can help you determine the potential return on your property investment, compare different properties and suburbs, and plan your cash flow and budget. It can also help you decide whether to sell or hold your property in the future.

There are two types of rental yield: gross rental yield and net rental yield.

Gross rental yield is a simpler calculation that looks at the annual rental income, measured against the value of your property.

Net rental yield is a more accurate calculation that factors in the ongoing expenses of your investment property, such as insurance, strata fees, repair costs and legal fees1.

Calculating Rental Yield

To calculate gross rental yield, you need to know the annual rental income and the property value. The formula is:

Gross rental yield = (annual rental income / property value) x 100

To calculate net rental yield, you need to know the annual rental income, the property value and the annual expenses. The formula is:

Net rental yield = (annual rental income - annual expenses) / property value) x 100

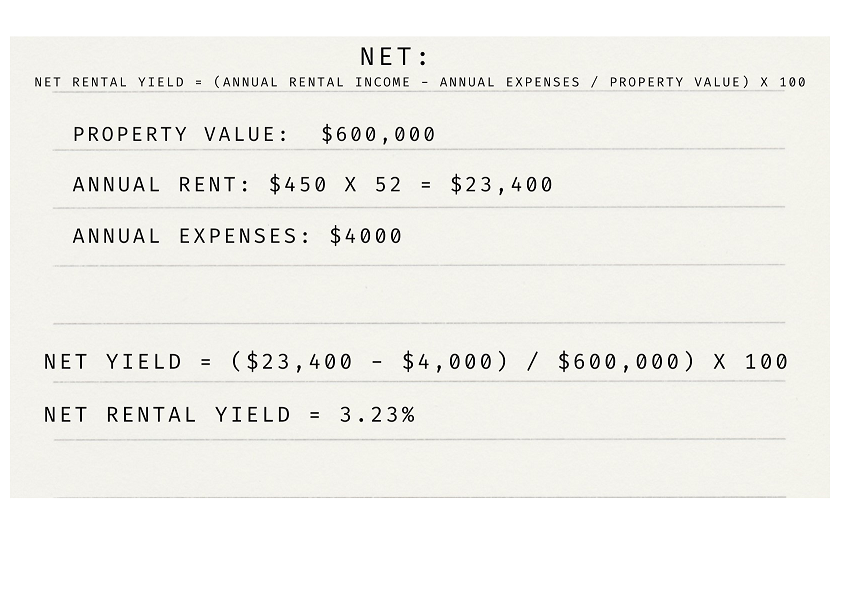

Here is an example of how to calculate both gross and net rental yield for an investment property:

Property value = $600,000

Weekly rent = $450

Annual rent = $450 x 52 = $23,400

Annual expenses = $4,000

Gross rental yield

($23,400 / $600,000) x 100 = 3.9%

Net rental yield

($23,400 - $4,000) / $600,000) x 100 = 3.23%

What is a Good Rental Yield?

There is no definitive answer to what constitutes a good rental yield. It may depend on factors such as location, property type, market conditions, capital growth potential and personal preferences.

Some general guidelines are:

- A gross rental yield of 5% or more is considered good for most property types in Australia2.

- A net rental yield of 3% or more is considered good for most property types in Australia3.

- A higher rental yield may indicate a higher cash flow and return on investment, but it may also reflect a lower capital growth potential or a higher risk profile.

- A lower rental yield may indicate a lower cash flow and return on investment, but it may also reflect a higher capital growth potential or a lower risk profile.

How to Use Rental Yield to Enhance Your Property Investment Portfolio

Rental yield can be a useful tool to help you enhance your property investment portfolio in several ways:

- You can use rental yield to compare different properties and suburbs and identify which ones offer better returns and suit your investment goals.

- You can use rental yield to monitor your cash flow and budget for your expenses and mortgage repayments.

- You can use rental yield to review your rent regularly and adjust it according to market demand and supply.

- You can use rental yield to assess the performance of your property over time and decide whether to sell or hold it in the future.

Rental yield is not the only factor to consider when investing in property, but it is an important one that can help you make informed decisions and maximise your returns.

References:

Rental yield explained: What is a good yield and how do you calculate .... https://www.lendi.com.au/inspire/property/rental-yield-explained/.

How to calculate rental yield | Westpac. https://www.westpac.com.au/personal-banking/home-loans/investing-in-property/rental-yield/.

What is Rental Yield & How to Work It Out - Mortgage Choice. https://www.mortgagechoice.com.au/guides/property-investment/what-is-rental-yield/.

What Does Rental Yield Mean - Domain.com.au. https://www.domain.com.au/answers/what-does-rental-yield-mean/.